All Categories

Featured

Table of Contents

We aren't just chatting about celebrating Consistency week each year; the differing experiences, viewpoints, skills and backgrounds of our mortgage brokers enables us to: Have a far better social relationship, far better links with and understanding of the requirements of customers. For one, it makes us subtly knowledgeable about the various cultural subtleties.

Besides, what we've seen is that normally, it's the older generation that favors to talk with somebody that speaks their language, although they might have remained in the nation for a very long time. It might be a social thing or a language barrier. And we comprehend that! No matter, every Australian demands to be 100% clear when making one of the greatest decisions in their life that is acquiring their very first home/property.

Value Residential Mortgage

For us, it's not only about the home mortgage. Most importantly, the home mortgage is a way to an end, so we make certain that the home lending is fit to your certain demands and objectives. In order to do this, we understand and maintain ourselves updated on the borrowing policies of almost 40 loan providers and the plan exceptions that can obtain an application approved.

, and various other areas where excellent clients are let down by the banks.

Secure Refinancing (Perth)

We respond to a few of one of the most frequently asked questions about accessing home loan brokers in Perth. The function of Perth mortgage brokers is to offer home mortgage funding options for their clients, using their neighborhood market understanding and experience. Perth home loan brokers, such as our team at Lendstreet, pride themselves on locating the most effective mortgage borrowing solution for your Perth home purchase while directing you through the entire procedure.

There are a great deal of home loan brokers in Perth. Right here are 10 great reasons to consider me above all the others. All missed out on telephone calls will be returned within 4 organization hours All emails got prior to 5pm will be responded to in the very same day Authorized credit rating representative (CRN: 480368) of AFG (ACL: 389087) Participant of the Mortgage & Finance Association of Australia (577975) Participant of the Australian Financial Complaints Authority or AFCA (52529) BSc Economics from the London Institution of Business Economics Diploma of Money and Home Mortgage Broking Monitoring Certificate IV in Finance and Home Loan Broking Component of a WA possessed and operated service whose emphasis is only on the Perth market.

All solutions come with no expense to you and there are no Clawback costs. Readily available to meet with you from 7 am to 7 pm weekdays and offered on weekend breaks. Over 1400 items, from greater than 30 lending institutions to select from. Our partnership does not finish with the settlement of your lending.

Detailed Mortgage Application Near Me

All info provided is kept in the strictest self-confidence and is handled in line with the 1988 Privacy Act.

In our experience as registered home loan brokers, we can take the burn out of home mortgage comparison. We contrast products from over 30+ lenders from the large banks to the tiny lenders. We make use of just the most effective and easy-to-use comparing devices to determine the most effective owner occupied or financial investment lending for you.

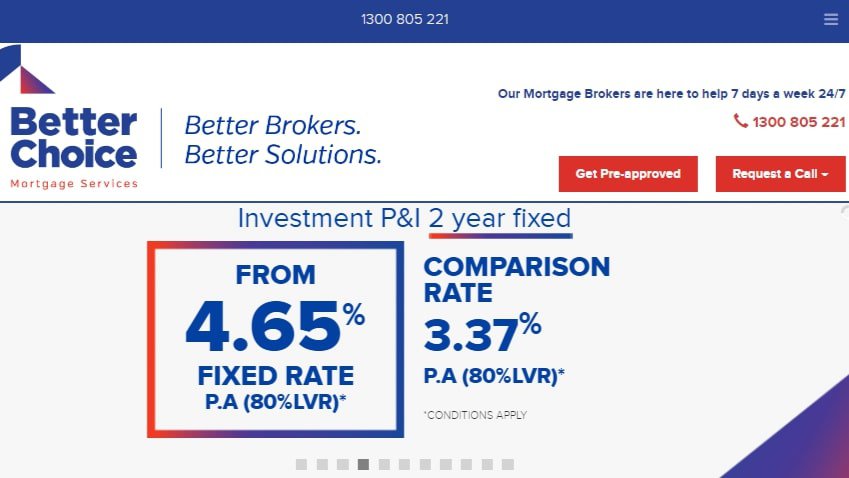

This in fact can make the loan item a lot more expensive in the long-term. The majority of banks will win over consumers by showing just the promoted passion price without factoring in elements that include onto your lending settlements.

High-Quality Mortgage Pre-qualification Near Me

With a lot information out there, finding the most effective home loan rates that best suit your financial situation can be a tough accomplishment. It's our task to give you with full item contrasts, consisting of all the covert charges and fees to ensure that you compare any type of mortgage item as properly as possible.

Our mortgage brokers have a collective 20+ years experience in the industry, are fully familiar with the patterns for the Perth market making us specialists for the job. By giving a comparison device that can aid you in making a better monetary choice, we're empowering borrowers and educating them along the method.

Thorough Variable-rate Mortgage (Perth)

All you need to do is offer us a call..

I act as the intermediary in between you and the loan provider, making sure a smooth and effective procedure, and saving you the anxiety. With nearly two years in the mortgage market, I use comprehensive suggestions on all facets of home mortgage loaning. Whether you're evaluating the advantages of a fixed-rate vs. an adjustable-rate home mortgage or concerned about car loan functions and charges, I'm below to give clearness and assistance.

My considerable experience and connections within the market enable me to safeguard much better passion prices and potentially also obtain certain costs waived for you. To sum up the above, the benefits of making use of the services of a mortgage broker such as myself include: My connections can open doors to funding choices you may not discover by yourself, customized to your distinct scenario.

Experienced Home Loan Options Near Me (Perth 6056 WA)

When you pick an ideal lending at an early stage, you'll rarely have to fret about whether or not you can still manage it when prices boost and you'll have an easier time handling your regular monthly settlements. Option is the greatest benefit that a mortgage broker can give you with (rate lock). The reason is that they have relationships with a vast array of lenders that include banks, building societies, and cooperative credit union

Overall, the quicker you function with a home loan broker, the better. That's since collaborating with one will certainly enable you to do even more in less time and obtain accessibility to better deals you most likely won't discover by yourself. Naturally you likewise have to be selective with the mortgage broker that you pick to utilize.

Apart from that, make sure that they are accredited - loan options. It might also be helpful to get recommendations from people you trust fund on brokers they have used in the past

A mortgage broker is an economic professional that is experts in home and investment finance funding. They link borrowers with possible lending institutions and help promote the entire procedure. When you connect with a licensed economic broker for a home loan or investment finance need, they will sit with you to comprehend your specific financial requirements and obtaining capacity and assist you safeguard an ideal funding at a market leading rate of interest.

Value Mortgage Application Near Me – Midland

We do not rely on offering an one time service but aim to support a trusted relationship that you can count on over and over again. We understand that every client has unique requirements, as a result, we aim to offer bespoke mortgage solutions that finest align with your choices each time. With an excellent track record of completely satisfied customers and hundreds of sustained positive Google assesses as social proof, we are the leading team you need to depend on for searching for and safeguarding your next mortgage authorization in Perth.

Latest Posts

Affordable Rates Credit Score For Mortgage Near Me – East Perth WA

Detailed Home Buying Process Near Me

High-Quality Residential Mortgage Near Me